HDFC Life Click 2 Protect Elite Plus

Claim Settlement Ratio 99% Amount Settlement Ratio 90%

Claim Settlement Ratio 99% Amount Settlement Ratio 90%

Click 2 Protect Elite Plus

HDFC Life Click 2 Protect Elite Plus is a pure protection term insurance plan created for individuals who want a high life cover at a cost-effective premium. The main objective of this plan is simple provide strong financial security to your family in case of any unfortunate event, without mixing it with heavy investment components. It is suitable for people who want long-term protection while keeping their premium budget under control.

Unlike traditional life insurance policies that combine savings and insurance, this plan focuses primarily on maximum protection. At the same time, it gives flexibility to customize the policy as per your needs. You can choose the coverage amount based on your income and responsibilities, decide the policy tenure according to your long-term financial goals, and select a premium payment option that suits your cash flow. The plan also allows you to decide how the claim payout should be made and add optional riders for enhanced protection.

For those who prefer some savings element along with protection, there is also a Return of Premium option. Under this feature, the total premiums paid during the policy term are returned at maturity if no claim is made. This makes the plan attractive for individuals who want life cover but also feel more comfortable knowing their premiums will not go unused.

Because of its flexibility, affordability, and strong protection focus, HDFC Life Click 2 Protect Elite Plus is considered one of the most reliable and widely chosen term insurance plans in India.

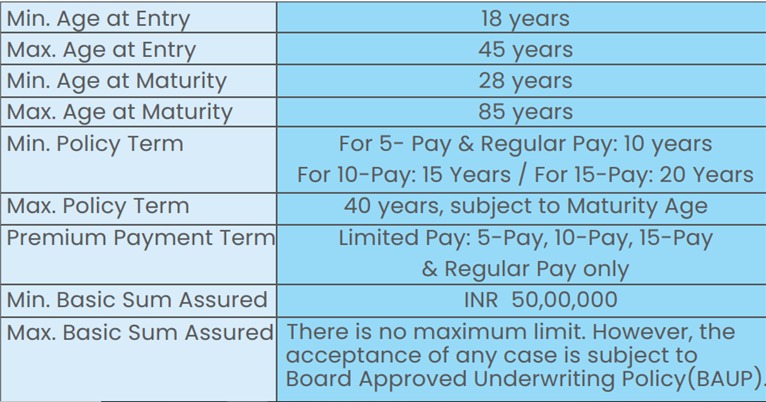

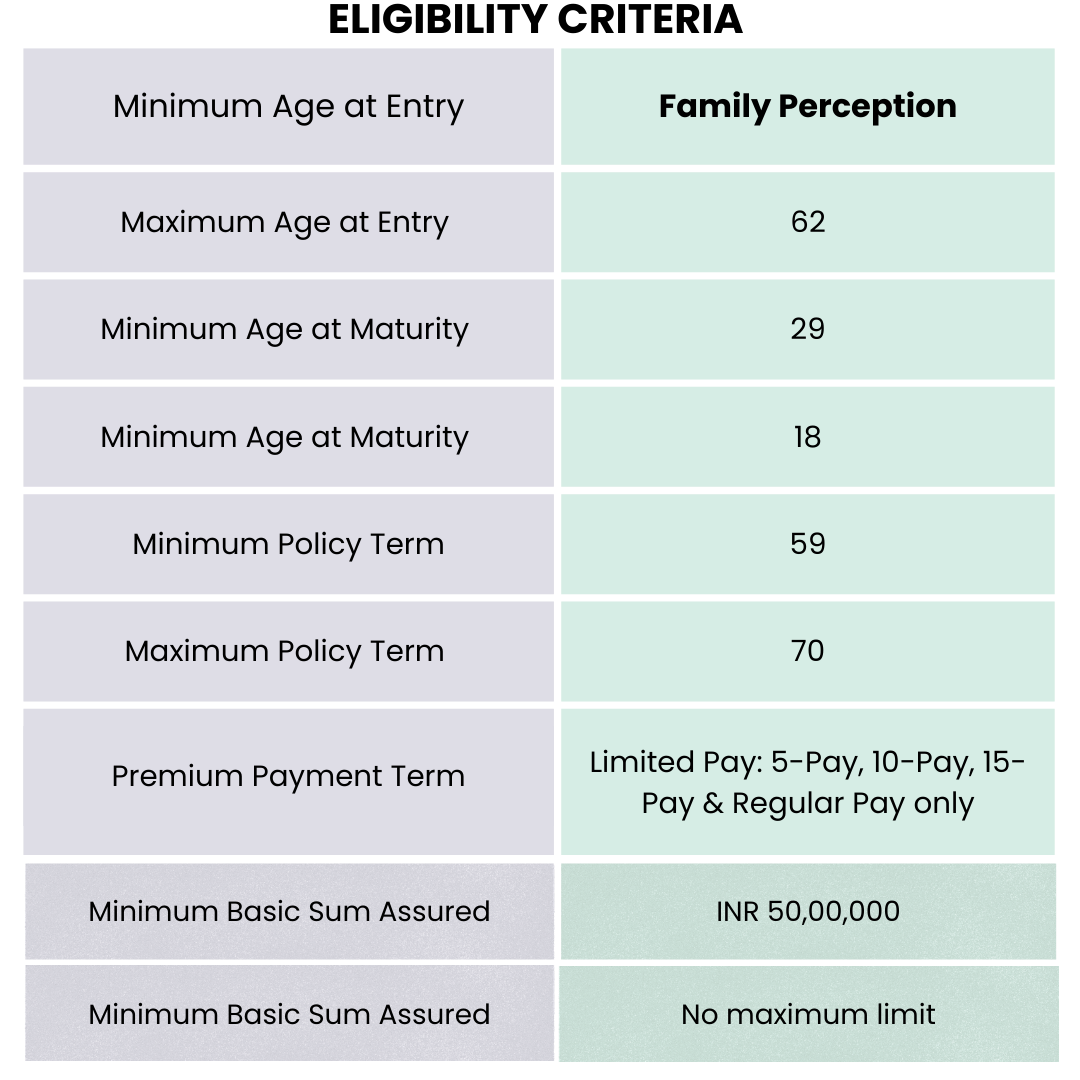

Eligibility Criteria of Click 2 Protect Elite Plus

Before purchasing HDFC Life Click 2 Protect Elite Plus, it is important to understand the eligibility criteria to ensure the plan aligns with your age, income stage, and long-term financial goals. This term insurance plan is designed to provide flexible entry options and extended coverage up to advanced ages, making it suitable for both young earners and mid-career professionals.

The minimum entry age for this term insurance plan is 18 years, while the maximum entry age is 45 years. The plan allows maturity up to 85 years of age, ensuring long-term financial protection for your family. The minimum age at maturity is 28 years, and the maximum maturity age depends on the policy term selected, subject to insurer guidelines.

In terms of policy tenure, the minimum policy term starts from 10 years for regular pay and 5 pay options. For 10 pay the minimum term is 15 years and for 15 pay it is 20 years. The maximum policy term can extend up to 40 years, depending on the selected maturity age. This flexibility helps policyholders align their term insurance coverage with retirement planning or long term liabilities.

The premium payment term under HDFC Life Click 2 Protect Elite Plus includes Limited Pay options such as 5-Pay, 10-Pay, and 15-Pay, along with Regular Pay. This allows individuals to choose a premium structure that suits their income flow and financial planning strategy. The minimum basic sum assured under this term insurance plan is INR 50,00,000. There is no predefined maximum sum assured limit; however, higher coverage amounts are subject to underwriting approval as per the insurer’s Board Approved Underwriting Policy.

Optional Benefits of HDFC Life Click 2 Protect Elite Plus

HDFC Life Click 2 Protect Elite Plus offers multiple optional benefits and flexible features that make this term insurance plan more adaptable to real-life financial needs. Along with high life cover, the plan allows policyholders to customize premium payment, claim payout, and policy continuation options. These features enhance long-term protection, liquidity support, and financial planning flexibility. Below are the key optional benefits explained in a simplified and structured format for better understanding:

1. Premium Frequency Change Option – The policyholder can change the premium payment frequency during the premium paying term. This flexibility allows you to switch between yearly, half-yearly, quarterly, or monthly modes based on your cash flow and financial planning needs.

2. Return of Premium (ROP) Option – By paying an additional premium at policy inception, you can opt for the Return of Premium feature. Under this option, 100% of the total premiums paid are returned as a lump sum on survival till maturity. This option is available only for specific policy term and premium payment combinations and cannot be discontinued once selected. It is suitable for individuals who want term insurance protection with premium refund benefit.

3. Renewability at Maturity – At the end of the policy term, you may extend your term insurance coverage without undergoing a fresh underwriting process, subject to guidelines. The renewed premium is calculated based on your attained age and extended tenure. This feature is available only under Regular Pay and when the Return of Premium option is not selected.

4. Immediate Claim Payout Support – In case of the unfortunate death of the life assured after completion of one policy year, an accelerated payout of INR 5 lakhs is provided within one working day of claim registration, subject to documentation and policy terms. The remaining death benefit is paid after claim assessment. This feature offers immediate financial relief to the nominee during difficult times.

5. Premium Break Benefit – After completing five policy years and meeting eligibility conditions, the policyholder can request a premium break of up to 12 months. During this period, the risk cover continues while premiums are deferred. The deferred premium must be cleared later to maintain policy continuity. This option is available multiple times with specific gap conditions and does not require any additional charge.

6. Grace Period for Premium Payment – The plan provides a grace period of 30 days for annual, half-yearly, and quarterly modes, and 15 days for monthly mode. The policy remains active during this period, and any unpaid premium is deducted from the claim amount if a claim arises.

7. Paid-Up Benefit – If Return of Premium is selected and at least one full year’s premium is paid, the policy may acquire a paid-up value. In case of premium discontinuation after acquiring paid-up status, the death benefit and maturity benefit are reduced proportionately based on premiums paid versus premiums payable. In other cases, the policy may lapse without paid-up value. These optional benefits make HDFC life click 2 protect elite plus one of the most flexible term insurance plan in india, offering enhanced protection, liquidity support and long term financial security.

Unexpired Risk Premium Value (Surrender Value)

If the Return of Premium (ROP) option is selected under HDFC Life Click 2 Protect Elite Plus, the policy can acquire a surrender value subject to certain conditions. In case of Single Pay, the Guaranteed Surrender Value (GSV) is acquired immediately after premium payment. For Limited Pay and Regular Pay options, the GSV is acquired after payment of at least two full years’ premiums.

Apart from the Guaranteed Surrender Value, the insurer may offer a Special Surrender Value (SSV), which can be higher than the GSV. The SSV becomes applicable after completion of the first policy year, provided at least one full year’s premium has been paid under Limited or Regular Pay. The final surrender value payable to the policyholder will be whichever is higher GSV or SSV.

The Guaranteed Surrender Value is calculated as a specified percentage (GSV factor) multiplied by the total premiums paid. The Special Surrender Value is determined based on the present value of paid-up guaranteed future benefits, including death benefit, maturity benefit (if applicable), and any accrued benefits, after adjusting for survival benefits already paid. The discount rate used for calculation is linked to government security yields and is reviewed periodically. Currently, the assumed rate is 7.75% per annum, and it may change based on market conditions.

If the Return of Premium option is not selected, the policy cancellation value (also known as unexpired risk premium value) is acquired only after at least one full year’s premium has been paid and the first policy year is completed under Limited Pay. In other cases, the policy may lapse without acquiring any surrender value. If acquired, this value becomes payable either upon death during the revival period or at the end of the revival period if the policy is not revived.

Smart Exit Benefit of HDFC Life Click 2 Elite Plus

The Smart Exit Benefit provides flexibility to exit the policy and receive back the total premiums paid, without paying any additional charge for this feature. This option can be exercised only after completing 25 policy years and cannot be used during the last five policy years. The policy must be active at the time of opting for this benefit.

This feature is not available if the Return of Premium option has been selected. The calculation of surrender-related values under this feature considers a discount rate linked to the 10-year Government Security yield plus an additional margin. These rates are reviewed periodically and may be revised for both new and existing policies.

Overall, these surrender and exit provisions in HDFC Life Click 2 Protect Elite Plus provide structured flexibility, allowing policyholders to manage long-term term insurance commitments based on changing financial priorities.

Exclusions of HDFC Life Click 2 Elite Plus

Like all term insurance policies, certain situations are not covered. Here are the general exclusions under this term insurance plan. The policy does not cover certain specific scenarios as defined by the insurer, such as claims arising from non-disclosure of material facts or conditions mentioned in the policy contract. Exclusions are clearly outlined in the policy document, and understanding them is important to avoid claim complications in the future:

1. Suicide Clause - Death due to suicide during the first policy year is not covered as per policy guidelines.

2. Fraud or Misrepresentation - Incorrect information or non-disclosure may result in claim rejection.

3. Rider-Specific Exclusions - Additional exclusions may apply to any optional riders chosen with the policy, depending on their specific terms and conditions. Therefore, it is always advisable to read the policy document carefully to fully understand the coverage details, limitations, and exclusions before purchasing the plan.

Claim Process of HDFC Life Click 2 Elite Plus

HDFC Life offers a simple and quick claim settlement process. Here is the general claim process for HDFC Life Click 2 Protect Elite Plus. In case of an unfortunate event, the nominee must intimate the insurer and submit the required documents as per the claim guidelines. Once the documents are verified and the claim is assessed as per policy terms, the death benefit is processed and paid to the nominee. Timely intimation and accurate documentation help ensure a smooth and faster claim settlement experience:

Step 1 – Inform the Insurer - Notify HDFC Life or PolicyHub immediately.

Step 2 – Submit Documents - Provide claim form, policy details, ID proof, and medical/legal documents.

Step 3 – Claim Verification - Insurer reviews the submitted documents.

Step 4 – Settlement - Approved claim amount is paid to nominee through selected payout option.

Eligibility Criteria of Click 2 Protect Elite Plus

Before purchasing HDFC Life Click 2 Protect Elite Plus, it is important to understand the eligibility criteria to ensure the plan aligns with your age, income stage, and long-term financial goals. This term insurance plan is designed to provide flexible entry options and extended coverage up to advanced ages, making it suitable for both young earners and mid-career professionals.

The minimum entry age for this term insurance plan is 18 years, while the maximum entry age is 45 years. The plan allows maturity up to 85 years of age, ensuring long-term financial protection for your family. The minimum age at maturity is 28 years, and the maximum maturity age depends on the policy term selected, subject to insurer guidelines.

In terms of policy tenure, the minimum policy term starts from 10 years for regular pay and 5 pay options. For 10 pay the minimum term is 15 years and for 15 pay it is 20 years. The maximum policy term can extend up to 40 years, depending on the selected maturity age. This flexibility helps policyholders align their term insurance coverage with retirement planning or long term liabilities.

The premium payment term under HDFC Life Click 2 Protect Elite Plus includes Limited Pay options such as 5-Pay, 10-Pay, and 15-Pay, along with Regular Pay. This allows individuals to choose a premium structure that suits their income flow and financial planning strategy. The minimum basic sum assured under this term insurance plan is INR 50,00,000. There is no predefined maximum sum assured limit; however, higher coverage amounts are subject to underwriting approval as per the insurer’s Board Approved Underwriting Policy.

Optional Benefits of HDFC Life Click 2 Protect Elite Plus

HDFC Life Click 2 Protect Elite Plus offers multiple optional benefits and flexible features that make this term insurance plan more adaptable to real-life financial needs. Along with high life cover, the plan allows policyholders to customize premium payment, claim payout, and policy continuation options. These features enhance long-term protection, liquidity support, and financial planning flexibility. Below are the key optional benefits explained in a simplified and structured format for better understanding:

1. Premium Frequency Change Option – The policyholder can change the premium payment frequency during the premium paying term. This flexibility allows you to switch between yearly, half-yearly, quarterly, or monthly modes based on your cash flow and financial planning needs.

2. Return of Premium (ROP) Option – By paying an additional premium at policy inception, you can opt for the Return of Premium feature. Under this option, 100% of the total premiums paid are returned as a lump sum on survival till maturity. This option is available only for specific policy term and premium payment combinations and cannot be discontinued once selected. It is suitable for individuals who want term insurance protection with premium refund benefit.

3. Renewability at Maturity – At the end of the policy term, you may extend your term insurance coverage without undergoing a fresh underwriting process, subject to guidelines. The renewed premium is calculated based on your attained age and extended tenure. This feature is available only under Regular Pay and when the Return of Premium option is not selected.

4. Immediate Claim Payout Support – In case of the unfortunate death of the life assured after completion of one policy year, an accelerated payout of INR 5 lakhs is provided within one working day of claim registration, subject to documentation and policy terms. The remaining death benefit is paid after claim assessment. This feature offers immediate financial relief to the nominee during difficult times.

5. Premium Break Benefit – After completing five policy years and meeting eligibility conditions, the policyholder can request a premium break of up to 12 months. During this period, the risk cover continues while premiums are deferred. The deferred premium must be cleared later to maintain policy continuity. This option is available multiple times with specific gap conditions and does not require any additional charge.

6. Grace Period for Premium Payment – The plan provides a grace period of 30 days for annual, half-yearly, and quarterly modes, and 15 days for monthly mode. The policy remains active during this period, and any unpaid premium is deducted from the claim amount if a claim arises.

7. Paid-Up Benefit – If Return of Premium is selected and at least one full year’s premium is paid, the policy may acquire a paid-up value. In case of premium discontinuation after acquiring paid-up status, the death benefit and maturity benefit are reduced proportionately based on premiums paid versus premiums payable. In other cases, the policy may lapse without paid-up value. These optional benefits make HDFC life click 2 protect elite plus one of the most flexible term insurance plan in india, offering enhanced protection, liquidity support and long term financial security.

Unexpired Risk Premium Value (Surrender Value)

If the Return of Premium (ROP) option is selected under HDFC Life Click 2 Protect Elite Plus, the policy can acquire a surrender value subject to certain conditions. In case of Single Pay, the Guaranteed Surrender Value (GSV) is acquired immediately after premium payment. For Limited Pay and Regular Pay options, the GSV is acquired after payment of at least two full years’ premiums.

Apart from the Guaranteed Surrender Value, the insurer may offer a Special Surrender Value (SSV), which can be higher than the GSV. The SSV becomes applicable after completion of the first policy year, provided at least one full year’s premium has been paid under Limited or Regular Pay. The final surrender value payable to the policyholder will be whichever is higher GSV or SSV.

The Guaranteed Surrender Value is calculated as a specified percentage (GSV factor) multiplied by the total premiums paid. The Special Surrender Value is determined based on the present value of paid-up guaranteed future benefits, including death benefit, maturity benefit (if applicable), and any accrued benefits, after adjusting for survival benefits already paid. The discount rate used for calculation is linked to government security yields and is reviewed periodically. Currently, the assumed rate is 7.75% per annum, and it may change based on market conditions.

If the Return of Premium option is not selected, the policy cancellation value (also known as unexpired risk premium value) is acquired only after at least one full year’s premium has been paid and the first policy year is completed under Limited Pay. In other cases, the policy may lapse without acquiring any surrender value. If acquired, this value becomes payable either upon death during the revival period or at the end of the revival period if the policy is not revived.

Smart Exit Benefit of HDFC Life Click 2 Elite Plus

The Smart Exit Benefit provides flexibility to exit the policy and receive back the total premiums paid, without paying any additional charge for this feature. This option can be exercised only after completing 25 policy years and cannot be used during the last five policy years. The policy must be active at the time of opting for this benefit.

This feature is not available if the Return of Premium option has been selected. The calculation of surrender-related values under this feature considers a discount rate linked to the 10-year Government Security yield plus an additional margin. These rates are reviewed periodically and may be revised for both new and existing policies.

Overall, these surrender and exit provisions in HDFC Life Click 2 Protect Elite Plus provide structured flexibility, allowing policyholders to manage long-term term insurance commitments based on changing financial priorities.

Exclusions of HDFC Life Click 2 Elite Plus

Like all term insurance policies, certain situations are not covered. Here are the general exclusions under this term insurance plan. The policy does not cover certain specific scenarios as defined by the insurer, such as claims arising from non-disclosure of material facts or conditions mentioned in the policy contract. Exclusions are clearly outlined in the policy document, and understanding them is important to avoid claim complications in the future:

1. Suicide Clause - Death due to suicide during the first policy year is not covered as per policy guidelines.

2. Fraud or Misrepresentation - Incorrect information or non-disclosure may result in claim rejection.

3. Rider-Specific Exclusions - Additional exclusions may apply to any optional riders chosen with the policy, depending on their specific terms and conditions. Therefore, it is always advisable to read the policy document carefully to fully understand the coverage details, limitations, and exclusions before purchasing the plan.

Claim Process of HDFC Life Click 2 Elite Plus

HDFC Life offers a simple and quick claim settlement process. Here is the general claim process for HDFC Life Click 2 Protect Elite Plus. In case of an unfortunate event, the nominee must intimate the insurer and submit the required documents as per the claim guidelines. Once the documents are verified and the claim is assessed as per policy terms, the death benefit is processed and paid to the nominee. Timely intimation and accurate documentation help ensure a smooth and faster claim settlement experience:

Step 1 – Inform the Insurer - Notify HDFC Life or PolicyHub immediately.

Step 2 – Submit Documents - Provide claim form, policy details, ID proof, and medical/legal documents.

Step 3 – Claim Verification - Insurer reviews the submitted documents.

Step 4 – Settlement - Approved claim amount is paid to nominee through selected payout option.