HDFC Life Click 2 Protect Supreme

Claim Settlement Ratio 99% Amount Settlement Ratio 90%

Claim Settlement Ratio 99% Amount Settlement Ratio 90%

HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme is a non-linked, non-participating, individual pure risk premium life insurance plan designed to provide comprehensive financial protection for your family. This term insurance plan offers flexible coverage options, increasing death benefits, terminal illness protection, accidental death cover, premium flexibility, and wellness services ensuring your loved ones remain financially secure at every life stage.

With plan options such as Life, Life Plus, and Life Goal, along with features like return of premium, spouse cover, and parent protect care, this policy is suitable for income earners, parents, and individuals seeking long-term family protection

Variant of HDFC Life Click 2 Protect Supreme

This plan offers three flexible coverage options. The premium will vary depending on the option you select. At the time of purchase, the policyholder can choose any one option based on their protection needs and long term financial planning goals:

1. Life Option - Under the Life Option, the insured person receives pure life cover for the entire policy term. In case of the unfortunate demise of the life assured during the policy period, the nominee will receive the death benefit as per policy terms.

2. Life Plus - Under the Life Plus Option, the policy provides life insurance coverage throughout the policy term, ensuring that in case of the unfortunate death of the life assured, the nominee receives the applicable death benefit. Similar to the Life option, the death benefit can also be accelerated if the life assured is diagnosed with a terminal illness, offering timely financial support during a critical situation. In addition to this, the plan offers an extra payout in case of accidental death during the policy term, meaning the nominee receives an additional amount over and above the base sum assured. This option is ideal for individuals who want enhanced financial protection along with accidental death coverage.

3. Life Goal Option - Under the Life Goal Option, the sum assured payable on death is not fixed throughout the policy term but varies depending on the policy year. The coverage structure is determined based on the selected Level Cover Period and Amortization Rate, allowing the policyholder to align the insurance coverage with specific financial commitments such as home loans or other long-term liabilities. As financial responsibilities reduce over time, the coverage can adjust accordingly, making this option suitable for those seeking a structured and goal-based life insurance solution.

Additionally if the life assured is diagnosed with a terminal illness, the death benefit can be paid in advance, helping the family to manage urgent medical or financial expenses.

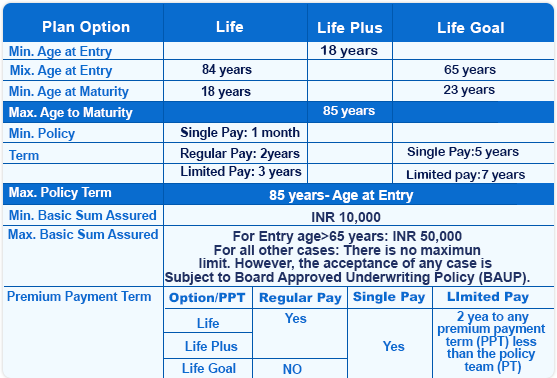

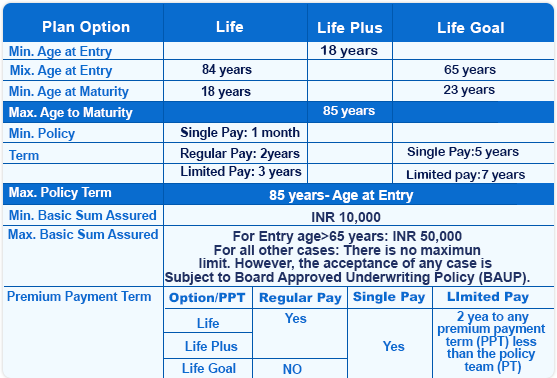

Eligibility Criteria of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme offers flexible eligibility conditions across all plan options, making it suitable for young professionals, parents, and individuals seeking long-term financial protection. The entry age, policy term, and premium payment options are structured to accommodate different income stages and life goals. Check the eligibility criteria as mentioned below:

Additional Benefit of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme offers multiple optional benefits that enhance basic term insurance coverage. Policyholders can add features like Return of Premium, Waiver of Premium on Critical Illness or Disability, Spouse Cover, Life Stage Benefit, and flexible payout options. These add Ons help customize your term plan based on changing life goals, health risks, and family protection needs and here are some optional benefits as mentioned below:

a. Return of Premium - The Return of Premium (ROP) option under HDFC Life Click 2 Protect Supreme allows the policyholder to receive 100% of the total premiums paid as a lump sum at maturity, provided they survive the full policy term. It applies to policy terms ranging from 10 to 40 years for Single, Regular, and 5 Pay options, while longer minimum terms apply for higher premium paying terms such as 6, 7, 8, 10, 12, 15, 20, and 25 years.

b. Waiver of Premium on Critical Illness - This option ensures that if the life assured is diagnosed with any of the specified critical illnesses, all future premiums under the term insurance plan are completely waived. Despite premium payments stopping, the life cover continues uninterrupted, along with accidental death benefit and terminal illness benefit.

c. Waiver of Premium on Total and Permanent Disability – This option allows the policyholder to stop paying all future premiums if the life assured suffers a total and permanent disability during the policy term. Even after premiums are waived, the term insurance coverage continues without interruption, including the base life cover, accidental death benefit, and terminal illness benefit.

d. Spouse Cover option - Under this if the life assured passes away during the policy term, the spouse receives a separate life cover equal to a selected percentage of the Basic Sum Assured for the remaining policy duration. This percentage is subject to the applicable BAUP limits and is capped at a maximum of 50%.

e. Death benefit as Instalment Option – This allows the nominee to receive the full or partial death benefit under the term insurance plan in structured instalments instead of a one-time lump sum. This option can be selected at policy inception or at the time of claim, and payouts can be spread over 5 to 15 years on a yearly, half-yearly, quarterly, or monthly basis.

f. Option to alter premium frequency - Under this option, the policyholder can choose to convert the outstanding regular premiums into HDFC Life Click 2 Protect Supreme A Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan 10 any limited premiums period available under the product.

g. Renewability Option at Maturity – This option allows the policyholder to extend the term insurance coverage at maturity without buying a new policy. This option is available only under the Regular Pay premium mode and can be chosen if Return of Premium, Waiver of Premium on Critical Illness, Waiver of Premium on Total and Permanent Disability or Spouse Cover has not been selected.

h. Life Stage Option - This allows the policyholder to increase the Sum Assured without fresh medical underwriting. The cover can be increased by up to 50% of the Basic Sum Assured maximum ₹50 lakhs on first marriage, and 25% each maximum ₹25 lakhs each on the birth of the first and second child.

i. Parent Secure Option - This option will have to be selected at inception. Under this option, the policyholder may opt for death benefit to be payable as instalments to the nominee. The instalment shall be payable as regular payouts till at least one nominee is alive. There can be a maximum of two nominees under this option.

j. Parent Protect Care - Under this the death benefit is paid partly as an immediate lump sum and the remaining amount as fixed regular payouts. The split between lump sum and regular income must be selected at policy inception, and at least 20% of the balance death benefit must be chosen for regular payouts.

k. Immediate Payout on Claim Intimation - If the life assured passes away after completing a waiting period of one policy year from the risk commencement date or policy revival, and the policy is active, the insurer provides an accelerated instant death benefit.

l. Premium Break Benefit – This allows the policyholder to pause premium payments for up to 12 months after completing five policy years, provided all due premiums are paid and the policy is active. A written request must be submitted in advance, and during this break period, the term insurance coverage continues as per policy terms. However, any deferred premiums will be deducted from the claim amount if a claim arises during this period.

m. Health management and well-being services - The benefit support prevention, diagnosis, treatment, and recovery. These services are optional, provided by third-party partners at no additional cost, and are available only to the life assured.

Exclusion of HDFC Life Click 2 Protect Supreme

Like all term insurance policies, HDFC Life Click 2 Protect Supreme is subject to certain exclusions as per policy terms and conditions. It is important to review these carefully to understand situations where benefits may not be payable:

a. Death due to suicide within 12 months from policy commencement or revival only premiums paid (excluding taxes) are refunded as per policy terms.

b. No maturity benefit payable if Return of Premium option is not selected.

c. Accidental death benefit not payable if policy conditions are not met. Refer to policy wording for the complete list of exclusions.

Waiting Period of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme has minimal waiting period conditions, ensuring immediate financial protection for your family from the start of the policy, subject to specific terms.

a. Suicide exclusion applies for 12 months from policy commencement or revival

b. No waiting period for natural or accidental death (other than suicide clause).

Variant of HDFC Life Click 2 Protect Supreme

This plan offers three flexible coverage options. The premium will vary depending on the option you select. At the time of purchase, the policyholder can choose any one option based on their protection needs and long term financial planning goals:

1. Life Option - Under the Life Option, the insured person receives pure life cover for the entire policy term. In case of the unfortunate demise of the life assured during the policy period, the nominee will receive the death benefit as per policy terms.

2. Life Plus - Under the Life Plus Option, the policy provides life insurance coverage throughout the policy term, ensuring that in case of the unfortunate death of the life assured, the nominee receives the applicable death benefit. Similar to the Life option, the death benefit can also be accelerated if the life assured is diagnosed with a terminal illness, offering timely financial support during a critical situation. In addition to this, the plan offers an extra payout in case of accidental death during the policy term, meaning the nominee receives an additional amount over and above the base sum assured. This option is ideal for individuals who want enhanced financial protection along with accidental death coverage.

3. Life Goal Option - Under the Life Goal Option, the sum assured payable on death is not fixed throughout the policy term but varies depending on the policy year. The coverage structure is determined based on the selected Level Cover Period and Amortization Rate, allowing the policyholder to align the insurance coverage with specific financial commitments such as home loans or other long-term liabilities. As financial responsibilities reduce over time, the coverage can adjust accordingly, making this option suitable for those seeking a structured and goal-based life insurance solution.

Additionally if the life assured is diagnosed with a terminal illness, the death benefit can be paid in advance, helping the family to manage urgent medical or financial expenses.

Eligibility Criteria of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme offers flexible eligibility conditions across all plan options, making it suitable for young professionals, parents, and individuals seeking long-term financial protection. The entry age, policy term, and premium payment options are structured to accommodate different income stages and life goals. Check the eligibility criteria as mentioned below:

Additional Benefit of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme offers multiple optional benefits that enhance basic term insurance coverage. Policyholders can add features like Return of Premium, Waiver of Premium on Critical Illness or Disability, Spouse Cover, Life Stage Benefit, and flexible payout options. These add Ons help customize your term plan based on changing life goals, health risks, and family protection needs and here are some optional benefits as mentioned below:

a. Return of Premium - The Return of Premium (ROP) option under HDFC Life Click 2 Protect Supreme allows the policyholder to receive 100% of the total premiums paid as a lump sum at maturity, provided they survive the full policy term. It applies to policy terms ranging from 10 to 40 years for Single, Regular, and 5 Pay options, while longer minimum terms apply for higher premium paying terms such as 6, 7, 8, 10, 12, 15, 20, and 25 years.

b. Waiver of Premium on Critical Illness - This option ensures that if the life assured is diagnosed with any of the specified critical illnesses, all future premiums under the term insurance plan are completely waived. Despite premium payments stopping, the life cover continues uninterrupted, along with accidental death benefit and terminal illness benefit.

c. Waiver of Premium on Total and Permanent Disability – This option allows the policyholder to stop paying all future premiums if the life assured suffers a total and permanent disability during the policy term. Even after premiums are waived, the term insurance coverage continues without interruption, including the base life cover, accidental death benefit, and terminal illness benefit.

d. Spouse Cover option - Under this if the life assured passes away during the policy term, the spouse receives a separate life cover equal to a selected percentage of the Basic Sum Assured for the remaining policy duration. This percentage is subject to the applicable BAUP limits and is capped at a maximum of 50%.

e. Death benefit as Instalment Option – This allows the nominee to receive the full or partial death benefit under the term insurance plan in structured instalments instead of a one-time lump sum. This option can be selected at policy inception or at the time of claim, and payouts can be spread over 5 to 15 years on a yearly, half-yearly, quarterly, or monthly basis.

f. Option to alter premium frequency - Under this option, the policyholder can choose to convert the outstanding regular premiums into HDFC Life Click 2 Protect Supreme A Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan 10 any limited premiums period available under the product.

g. Renewability Option at Maturity – This option allows the policyholder to extend the term insurance coverage at maturity without buying a new policy. This option is available only under the Regular Pay premium mode and can be chosen if Return of Premium, Waiver of Premium on Critical Illness, Waiver of Premium on Total and Permanent Disability or Spouse Cover has not been selected.

h. Life Stage Option - This allows the policyholder to increase the Sum Assured without fresh medical underwriting. The cover can be increased by up to 50% of the Basic Sum Assured maximum ₹50 lakhs on first marriage, and 25% each maximum ₹25 lakhs each on the birth of the first and second child.

i. Parent Secure Option - This option will have to be selected at inception. Under this option, the policyholder may opt for death benefit to be payable as instalments to the nominee. The instalment shall be payable as regular payouts till at least one nominee is alive. There can be a maximum of two nominees under this option.

j. Parent Protect Care - Under this the death benefit is paid partly as an immediate lump sum and the remaining amount as fixed regular payouts. The split between lump sum and regular income must be selected at policy inception, and at least 20% of the balance death benefit must be chosen for regular payouts.

k. Immediate Payout on Claim Intimation - If the life assured passes away after completing a waiting period of one policy year from the risk commencement date or policy revival, and the policy is active, the insurer provides an accelerated instant death benefit.

l. Premium Break Benefit – This allows the policyholder to pause premium payments for up to 12 months after completing five policy years, provided all due premiums are paid and the policy is active. A written request must be submitted in advance, and during this break period, the term insurance coverage continues as per policy terms. However, any deferred premiums will be deducted from the claim amount if a claim arises during this period.

m. Health management and well-being services - The benefit support prevention, diagnosis, treatment, and recovery. These services are optional, provided by third-party partners at no additional cost, and are available only to the life assured.

Exclusion of HDFC Life Click 2 Protect Supreme

Like all term insurance policies, HDFC Life Click 2 Protect Supreme is subject to certain exclusions as per policy terms and conditions. It is important to review these carefully to understand situations where benefits may not be payable:

a. Death due to suicide within 12 months from policy commencement or revival only premiums paid (excluding taxes) are refunded as per policy terms.

b. No maturity benefit payable if Return of Premium option is not selected.

c. Accidental death benefit not payable if policy conditions are not met. Refer to policy wording for the complete list of exclusions.

Waiting Period of HDFC Life Click 2 Protect Supreme

HDFC Life Click 2 Protect Supreme has minimal waiting period conditions, ensuring immediate financial protection for your family from the start of the policy, subject to specific terms.

a. Suicide exclusion applies for 12 months from policy commencement or revival

b. No waiting period for natural or accidental death (other than suicide clause).

Our Faq Us

Get This Asked Answers

Common Questions

No FAQs available for this page.